VIX Surge: Economic Data Disruption and Market Slump

Wall Street's October Reality Check: Data Delays, Rate Fears, and ViXplosions

Market Jitters: A Triple Threat

The market took a beating on Thursday, with both the SPY and QQQ ETFs dropping over 1.5%. What's behind this sudden bout of investor angst? It seems a perfect storm is brewing: delayed economic data, rising rate hike fears, and a resurgent Volatility Index (VIX).

First, the data drought. The shutdown hangover is real. Key economic reports like the October CPI and jobless claims are MIA. National Economic Council Director Kevin Hassett is promising September's jobs report next week, but October's unemployment rate? Forget about it. This lack of transparency injects uncertainty into the market (always bad). How can investors make informed decisions when the economic picture is incomplete? And, more importantly, is this a temporary blip or a sign of deeper systemic issues within our data collection processes?

Then there's the Fed. Multiple Fed officials are hinting that inflation (last clocked at 3%) is stickier than anticipated, throwing a wrench into hopes for a December rate cut. The CME's FedWatch tool reflects this shift. The odds of a 25 bps rate cut in December have plummeted from 69.6% a week ago to a coin-flip 51.9%. That's a significant sentiment shift in just seven days. It also raises a critical question: is the market too reliant on the Fed's dovish signals?

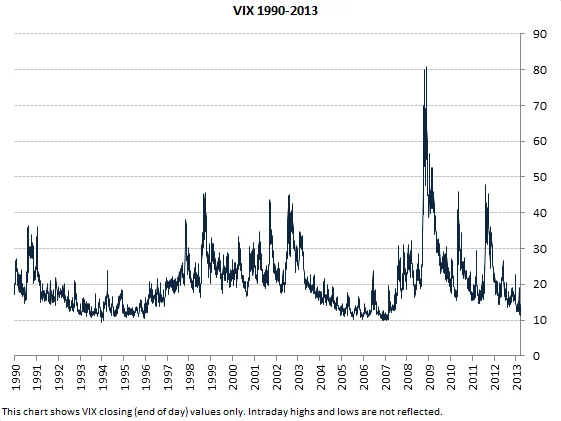

Finally, volatility is back. The VIX spiked 15% today, a clear sign of increased market unease. CNN's Fear and Greed Index has plunged into "extreme fear" territory. This isn't just a minor correction; it's a visceral reaction to the converging headwinds. I've seen similar patterns before, and they rarely resolve quickly. Stock Market News Review: SPY, QQQ Slump on Economic Data Disruption as VIX Surges 15%

Beneath the Surface: Cracks in the Foundation?

The official narrative is "post-shutdown jitters." But let's dig a little deeper. Are these data delays merely an inconvenience, or do they expose a more fundamental vulnerability in our economic reporting infrastructure? White House Press Secretary Karoline Leavitt went so far as to suggest that "The Democrats may have permanently damaged the federal statistical system.” That's a bold claim. What's the real extent of the damage?

The labor market is also flashing warning signs. Challenger, Gray & Christmas reported 153,074 job cuts in October, the highest since 2003. Is this a one-off event, or the start of a broader trend? The Fed is caught in a bind. Higher rates fight inflation but can also stifle economic growth and hurt employment. Lower rates can stimulate growth but risk fueling inflation further. It's a classic no-win scenario.

And this is the part of the report that I find genuinely puzzling. The market seems to be hyper-focused on the timing of the next rate cut (December, March, whenever). But shouldn't we be more concerned with the magnitude and duration of those cuts? A small, short-lived rate cut might not be enough to offset the underlying economic weakness.

A Glimmer of Hope? (Maybe)

Amidst all this doom and gloom, it's worth noting that not all sectors are suffering. ViX (not the VIX, but TelevisaUnivision's streaming platform) is set to premiere William Levy's new film, "Bajo un volcán." A completely unrelated data point, yes, but a reminder that life goes on, even when the market is in turmoil. And hey, maybe a good action-romance flick is exactly what investors need to take their minds off the red numbers.

Data Doesn't Lie: It Just Asks More Questions

The market's October reality check isn't just about delayed data and rate fears. It's a symptom of a deeper unease about the underlying health of the economy and the effectiveness of the Fed's toolkit. The VIX spike is a flashing red light. The question isn't "when will the market recover?" but "what fundamental changes are needed to restore investor confidence?