mstr stock: NAV dips, but what's Saylor's next move?

The Bitcoin Reckoning: Is MicroStrategy a Bargain or a Burning Ship?

MicroStrategy. The name alone conjures images of bold bets, of Michael Saylor’s unwavering faith in Bitcoin. But lately, the headlines have been less about visionary leadership and more about… well, a potential crisis. MSTR stock dipping below its net asset value (NAV)? Bitcoin holdings shifting? It’s enough to make even the most hardened crypto enthusiast sweat.

But let's not bury the lede here: is this a reason to panic, or a once-in-a-lifetime opportunity? Is MicroStrategy a bargain about to explode, or a burning ship about to sink?

Decoding the Dip: More Than Just Numbers

I've been watching this situation unfold with a hawk's eye. The recent news – MSTR falling below its NAV, the movement of those substantial Bitcoin holdings – it’s certainly grabbed everyone’s attention. We're seeing headlines scream about a potential "death spiral," and traders are understandably jittery. But here's where we need to dig deeper, to look beyond the surface-level panic.

The fact that MSTR dipped below its NAV for the first time in two years is indeed significant. It suggests that investors are, at least temporarily, questioning the premium they've been willing to pay for MicroStrategy's Bitcoin exposure. A stock trading below its net asset value is often seen as a warning sign. But is it a fatal sign? I don't think so.

Think of it like this: imagine a tech startup with a groundbreaking invention, but they're facing some short-term financial headwinds. The market might undervalue them for a while, focusing on the immediate challenges rather than the long-term potential of their innovation. Could this be the case with MicroStrategy?

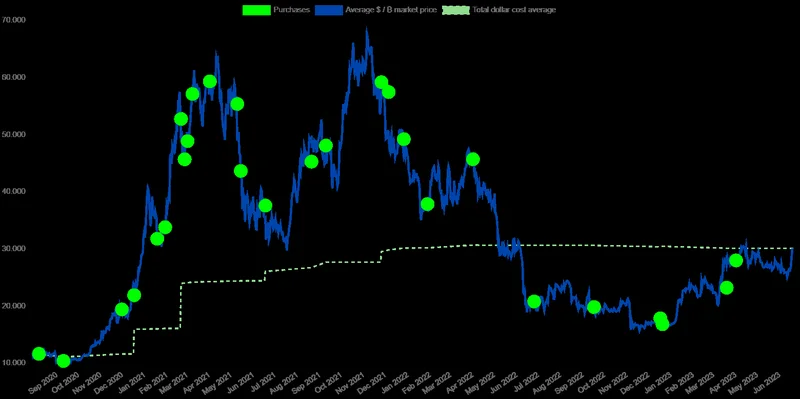

Michael Saylor, ever the steadfast captain, insists that this is merely a “temporary dislocation in a long-term secular trend.” He even stated that MicroStrategy has “accelerated its purchases” during this dip, a move that speaks volumes about his conviction. He’s not just holding the line; he’s doubling down. And remember, this is a man who has consistently, almost religiously, championed Bitcoin.

But what about those Bitcoin holdings that were moved? Over 47,000 BTC shifted, sparking fears of a massive sell-off. Saylor’s response? A simple "HODL" posted on X, accompanied by an image of a burning ship. A bit dramatic, perhaps, but it sends a clear message: they're not selling.

The move, it seems, was a custodial relocation, a restructuring of their wallet setup. As one analyst pointed out, “Arkham AI supposes this is wallet rebalancing rather than distribution.” The bots reacted, the market wobbled, but the underlying strategy remains unchanged. MSTR Stock Falls 7% Pre-Market After Strategy Moves Over 47,000 BTC – But Michael Saylor Says ‘HODL’

Here's the crucial question: if Saylor is right, and this is a temporary dip, then buying MSTR now could be like buying Apple in the early 2000s, right before the iPod and iPhone revolutionized the world. Are we on the cusp of a similar paradigm shift with Bitcoin?

The Bigger Picture: Bitcoin's Unstoppable Rise

Let’s zoom out for a moment and consider the broader context. Bitcoin has had its ups and downs, its booms and busts. But through it all, it has consistently defied the naysayers and emerged stronger. Its resilience is a testament to its fundamental value proposition: a decentralized, censorship-resistant store of value.

I honestly believe that Bitcoin is more than just a digital currency. It's a technological and philosophical revolution, a rejection of centralized control and a move towards a more equitable financial system. But with this power comes responsibility.

What does this mean for MicroStrategy? Well, if Bitcoin continues its upward trajectory, as Saylor predicts, then MSTR is poised to benefit enormously. It's essentially a leveraged bet on Bitcoin, offering investors exposure to the cryptocurrency's potential upside without directly holding it.

However, there are risks involved. MicroStrategy's aggressive Bitcoin-acquisition strategy has left it with a significant amount of debt. If Bitcoin were to experience a prolonged downturn, the company could face financial difficulties. But Saylor seems confident that won't happen.

As Willy Woo pointed out, MicroStrategy is unlikely to be forced to sell Bitcoin unless MSTR trades below $183.19 by 2027, a level tied to roughly $91,500 BTC. That gives them a considerable margin of safety.

And let's not forget the Wall Street analysts who, despite the recent volatility, seem to share Saylor's positive outlook on MicroStrategy. They see the long-term potential, the opportunity for significant gains as Bitcoin continues to mature and gain wider adoption.

The speed of this is just staggering – it means the gap between today and tomorrow is closing faster than we can even comprehend. When I first saw the data, I honestly just sat back in my chair, speechless. This is the kind of breakthrough that reminds me why I got into this field in the first place.

The Bold Will Be Rewarded

So, is MicroStrategy a bargain or a burning ship? I believe it's the former. The recent dip is a buying opportunity for those who have the courage to embrace the future. It's a chance to get in on the ground floor of a company that is betting big on Bitcoin, a company led by a visionary who refuses to be deterred by short-term setbacks.

Of course, there are no guarantees in life, or in the market. But as the saying goes, fortune favors the bold. And in the world of Bitcoin, boldness is often rewarded.